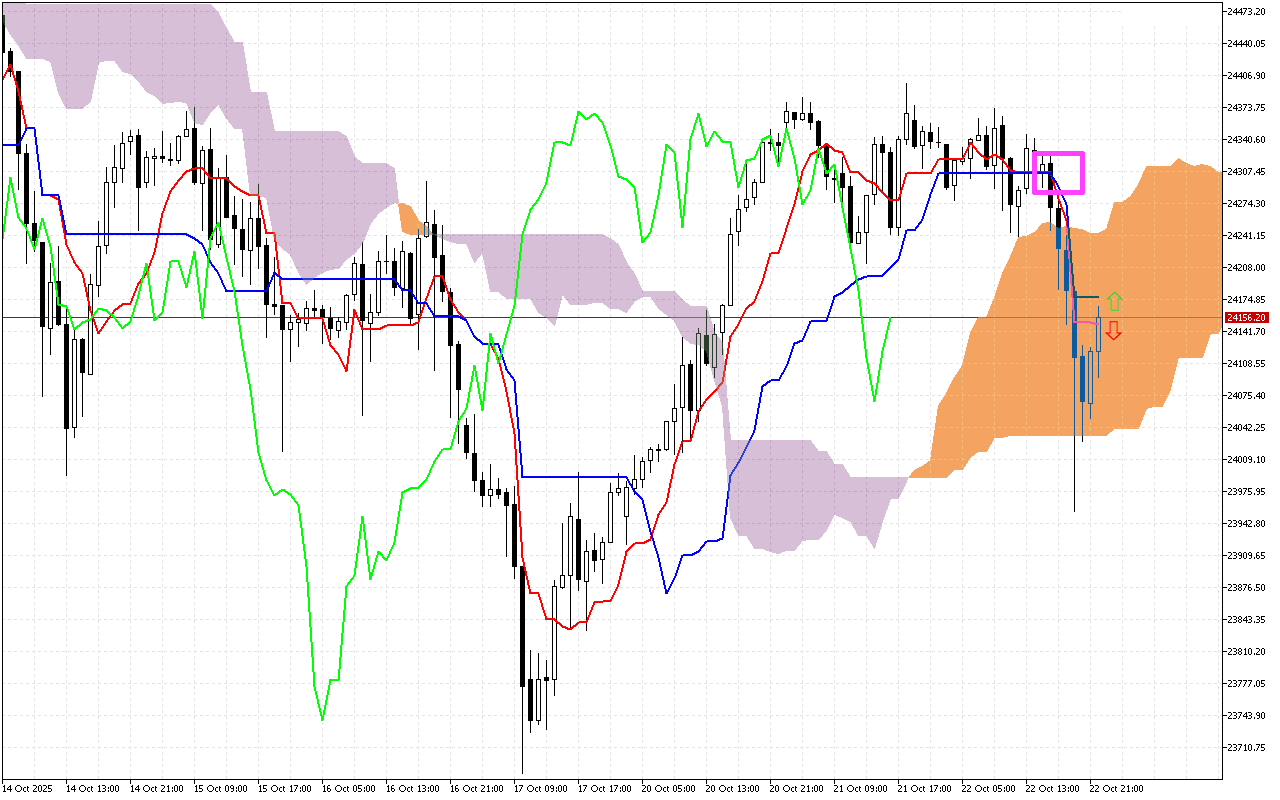

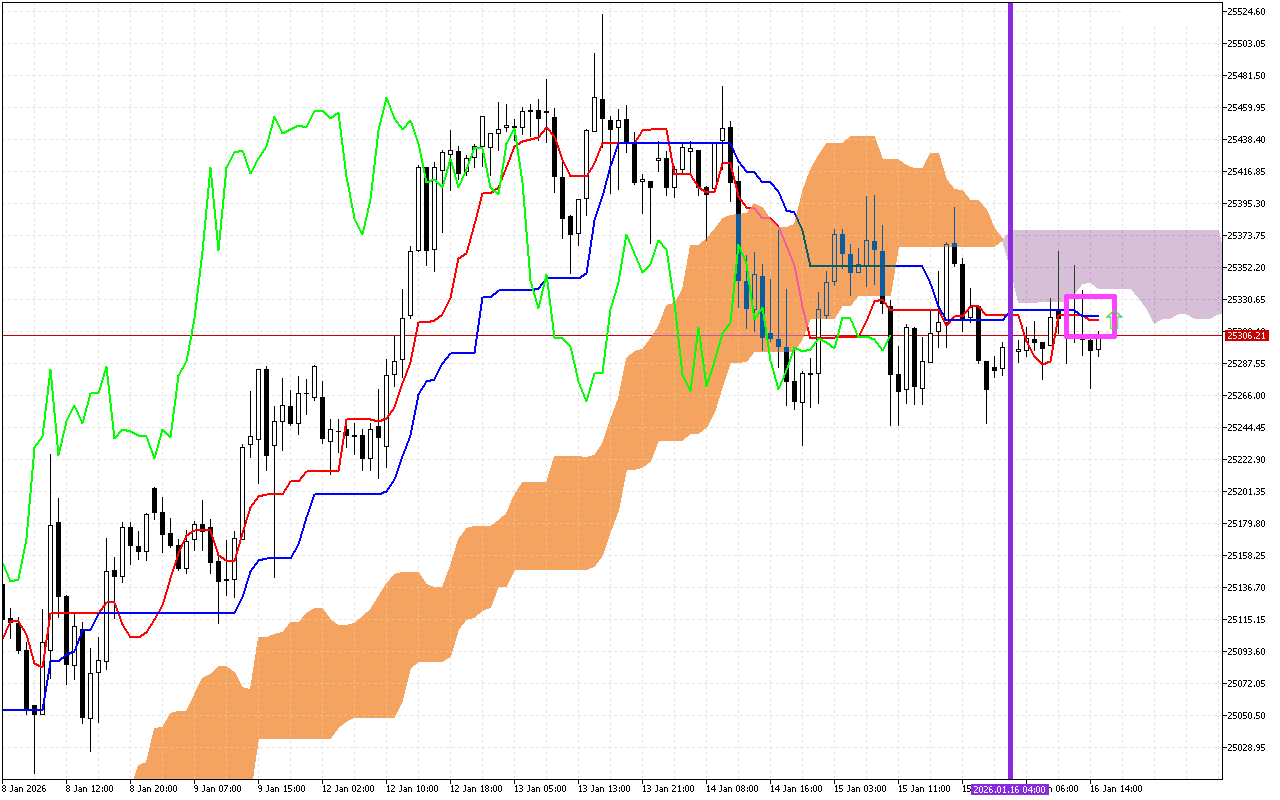

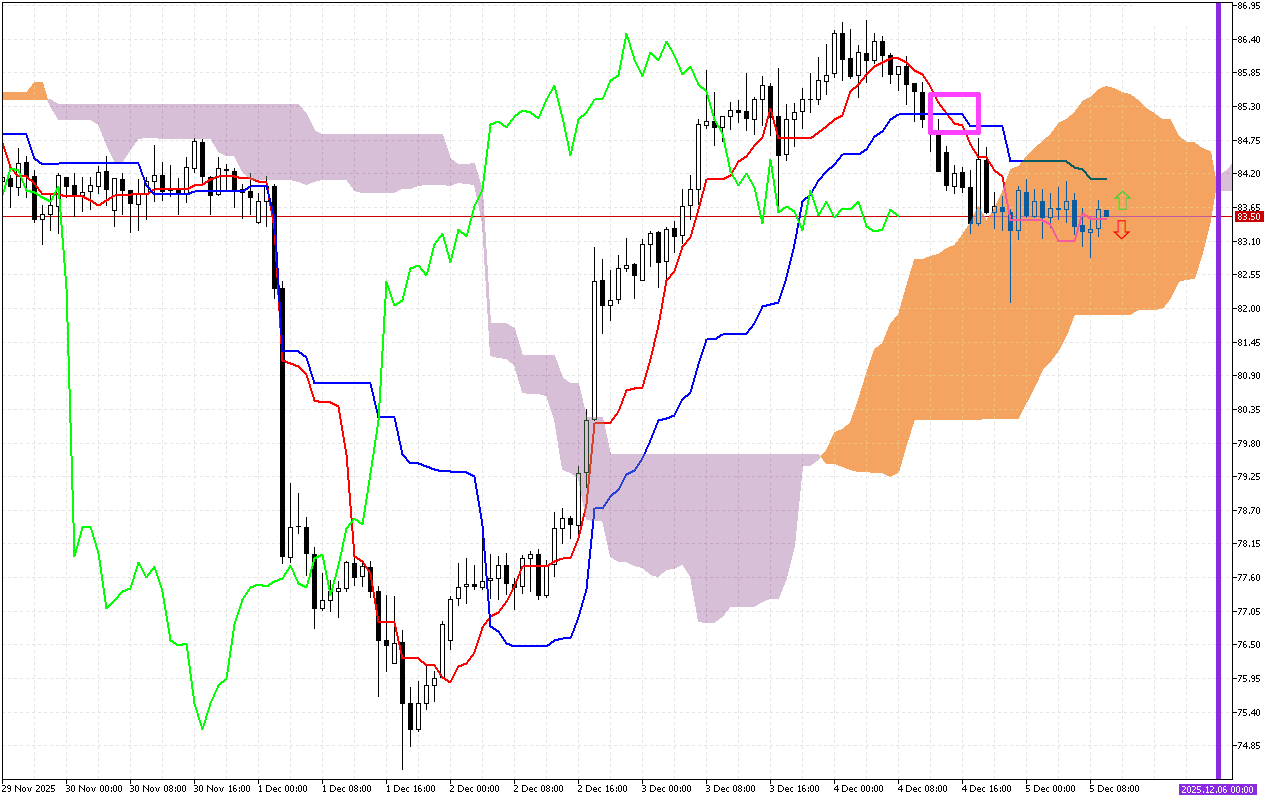

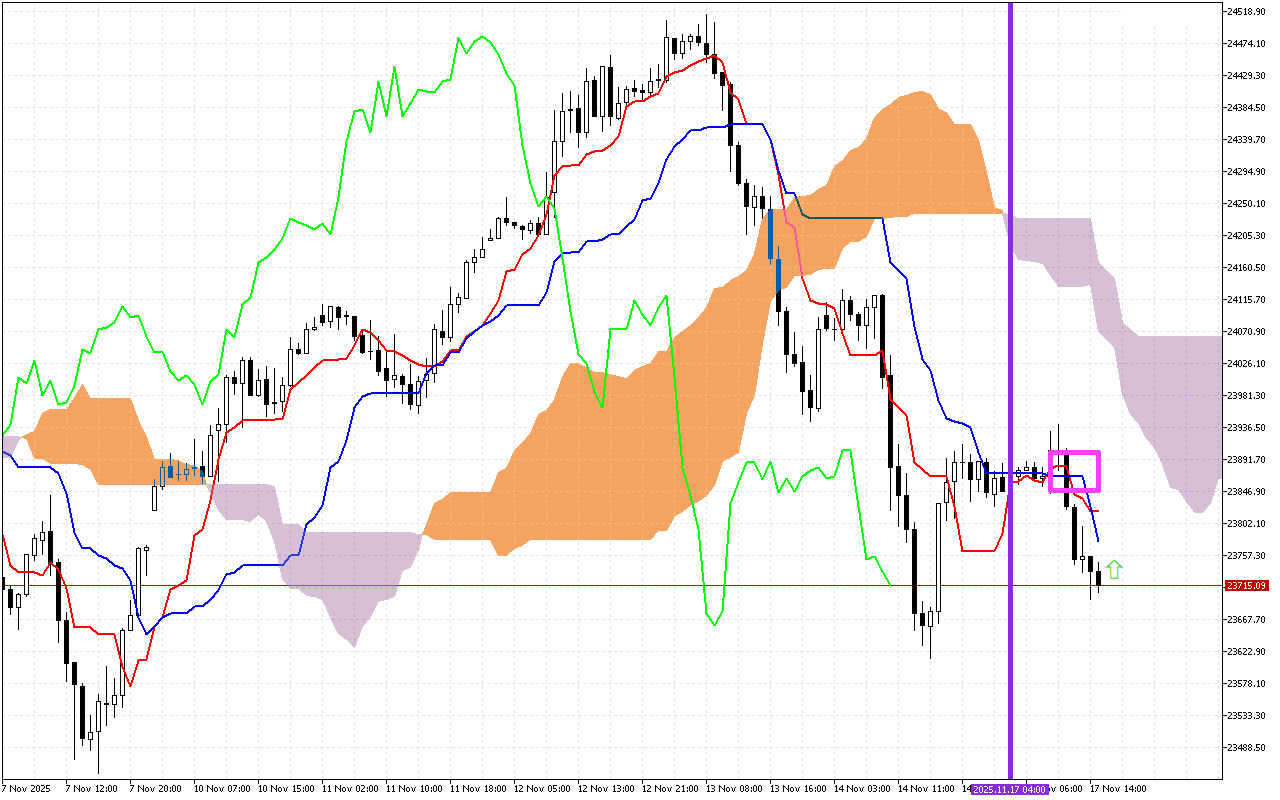

During previous trading sessions, the intersection of the Tenkan and Kijun lines, marked with a pink square, was observed on the DAX 40 chart. This signal indicates a potential change in the downward trend.

The second important signal is a change in the color of the Kumo cloud, which is marked with a vertical purple line on the graph. The appearance of a lilac color in the cloud indicates a change in the priority direction of movement to downward.

The current situation

Let’s carefully look at the current values of the main components of the Ichimoku indicator to assess the current state of the market:

The Tenkan and the Kijun lines are positioned above the current price. It indicates a negative market sentiment in the moment.

Now the Kumo cloud is tinted lilac, which indicates a possible change in price dynamics in a negative direction.

The price is between the SenkouA and SenkouB lines, which act as support and resistance levels. To clarify the market situation, it is worth waiting until the price goes beyond the Kumo cloud.

Used by investors to identify a change in trend, the green Chikou line is held below the price on the chart.

Trading recommendations:

The dynamic support level is on the SenkouB line, around the 24033.74 mark.

Dynamic resistance levels are on the Tenkan line, around the 24150.67, the Kijun line, around the 24176.68, and the SenkouA line, around 24242.78.

The main Ichimoku system indicators prioritize searching for entry points into short positions, on a price rollback to the resistance levels.